May 2023 Commentary & Performance Review

Traders are beginning to express skepticism about the sustainability of the stock rally year-to-date and are issuing warnings about a potential market downturn later in the year. Despite optimism surrounding a US debt-ceiling resolution and artificial intelligence, many believe that earnings expectations and economic uncertainties provide little reason for positive momentum to continue. The lack of broad participation in the market’s advance is a cause for concern as most of the gains seen thus far have been concentrated in a handful of stocks.

The stock market is experiencing a tech-powered rally driven by artificial intelligence (AI) that has sparked both enthusiasm and criticism. A few dominant tech stocks, such as Apple, Microsoft, Alphabet, Amazon, Meta Platforms, and Tesla, have shouldered a significant portion of the market’s gains, leading to concerns about the market’s dependence on these companies, although some investors view these tech stocks as safe havens amid sticky inflation and restrictive monetary policies. While anxieties persist, the market has remained resilient, and the bearish stance leaves it open to further upside.

Hedge funds are utilizing generative AI to speed up mundane activities such as reviewing market research, writing code, and summarizing fund performance. While these AI tools offer productivity gains, they are not yet transforming day-to-day investing methods. The goal is to improve performance, but currently, the emphasis is on automating routine work and enhancing efficiency. Some hedge funds are exploring the use of ChatGPT to analyze academic papers, detect patterns in data, and assist with investor relations. Despite the potential, there are limitations to the technology, including accuracy issues and concerns about data security. The impact of generative AI on the human workforce in the industry remains uncertain, but it could create opportunities for creative employees and potentially automate the innovation process itself.

Germany has entered its first recession since the start of the pandemic, dashing hopes that the country could avoid such an outcome amid soaring energy prices caused by the war in Ukraine. The statistics office reported a 0.3% contraction in first-quarter output, following a 0.5% decline in the previous quarter. The decline was attributed to reduced household spending on various items, lower government expenditure, and decreased demand for domestic cars. Despite a weakening economy, the DAX Index, which is the German equivalent of the Dow Jones Index in the U.S., is trading near all-time highs.

Pension programs, both government and private, are facing unprecedented challenges in the global economy. In addition to risks associated with inflation, government debt, and global conflicts, the number of retirees is increasing, leading to a significant rise in beneficiaries and expenditures. However, Canada’s Old Age Security (OAS) program remains resilient. Projections indicate that economic growth will outpace the rise in pension benefits, resulting in expenses growing less than revenues. OAS expenses are expected to peak at around 3.1% of GDP by 2035, gradually declining thereafter.

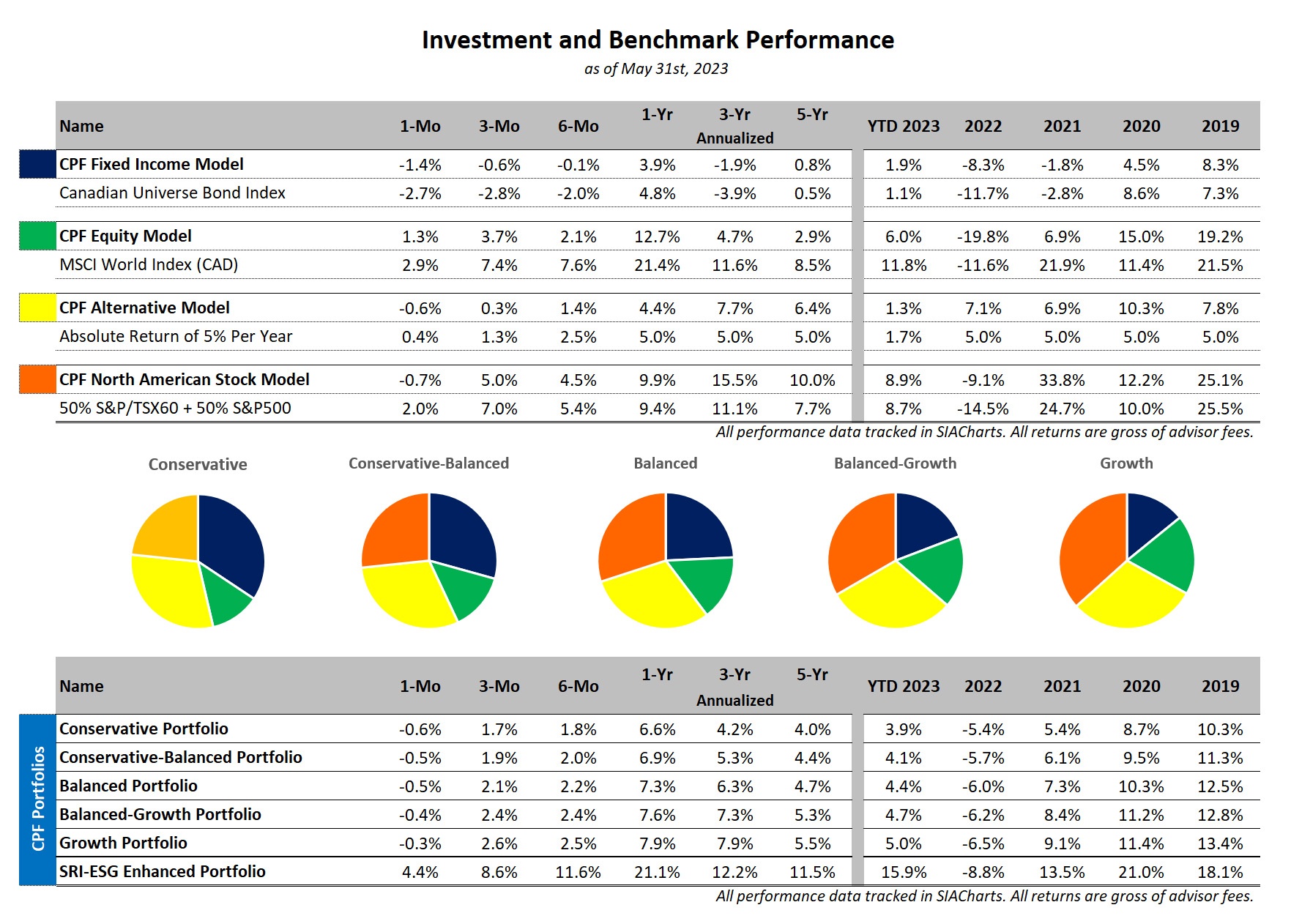

Portfolio Contributors

- Shares of Apple Inc (APPL) were up 4.14% this month after Apple’s iPhone revenue grew 2% annually to $51.3 billion. Service revenue set an all-time revenue record of $20.9 billion.

- ARK Innovation ETF (ARKK) was up 13.07% due to an increase in vehicle production volume by Tesla and potential business expansion in China (the world’s largest electric-vehicle market).

Portfolio Detractors

- Shares of Abbott Laboratories (ABT) fell this month, down 6.26%. This was caused by a 78% decrease in COVID-19 test sales.

- The Procter and Gamble Company (PG) was down 5.98% this month after a 10% price increase contributed to a sales drop which decreased revenue.

All returns are for the reported month and in local‐currency.

All data sourced from SIACharts and FACTSET.