Bringing Clarity

How We Manage Money

Our team’s experience, through good times and bad, guides our decisions and gives us the wisdom to properly steward your investments.

Our discretionary wealth management program and registration as Portfolio Managers gives us the right platform to operate from. Our trades on this platform are executed in real time for all clients at the same time – regardless of the size of the portfolio – so there are no delays in shifting investments when it’s needed.

Our asset allocation process is well established and forms the foundation for how we manage portfolios. We believe asset allocation decisions are paramount to delivering superior investment returns.

Asset allocation involves dividing an investment portfolio among different asset categories, such as stocks, bonds, alternatives and cash. The process of determining which mix of assets to hold in your portfolio is a very personal one and we work with each client to carefully consider their goals, risk tolerance and investment horizon to arrive at a proper allocation.

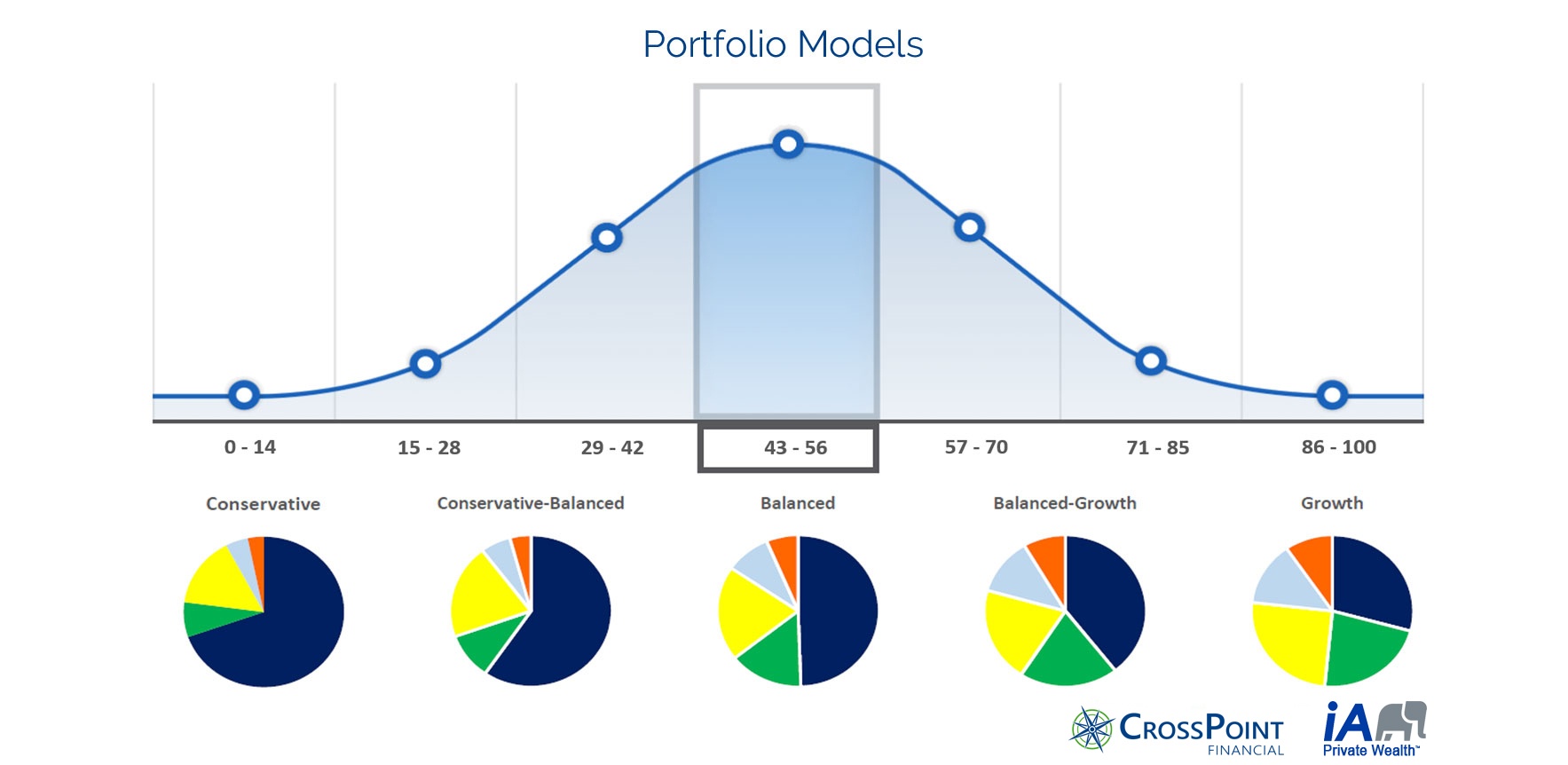

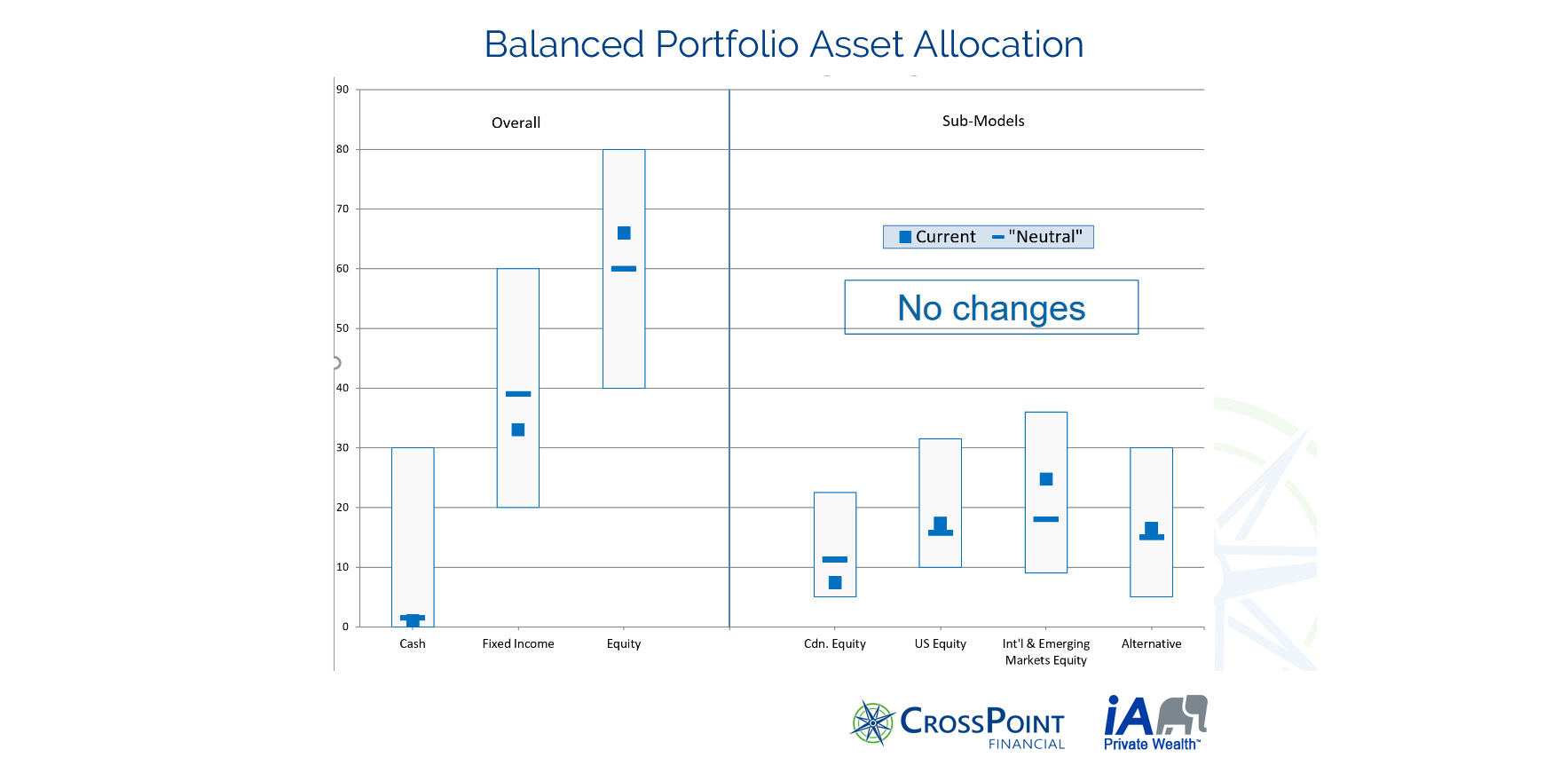

Below is a sample of the results of a risk tolerance assessment that determines a unique ‘risk score’. This risk score aligns with an asset allocation mix and one of our model portfolios. The asset allocation for our Balanced Portfolio is shown and you can see how we move the weightings up and down within the allowable ranges. This process maintains a high level of discipline and consistency and it provides a proper framework for decision-making.

Human Behaviour and Cognitive Biases

One key risk to investors, and where a skilled advisor can add value, is understanding the risks that our human behavior and biases bring to investing. We act as guides and coaches to help clients make the best decisions, even at the hardest times. We know that left on their own, the average investor only captures a small part of the returns the market offers. We strive to help our clients increase this “upside capture” by making good decisions (often to stay invested) despite their emotions that might be screaming at them to make the wrong decision.

For more information on this topic, please see the famed work of Kahneman and Tversky and, if you like reading, here is a great article on the topic.

Value of Advice

“If you think it’s expensive to hire a professional, wait until you hire an amateur.”

Red Adair

We strongly believe in the value of advice. Working with a professional cannot be substituted and costs alone should not be the criteria for determining value. It’s simply much more complicated than just that – so many factors go into how a trusted advisor can help you over time. Studies have shown that a good advisor can add upwards of 3% per year in returns.

Maybe not every year (and you shouldn’t be evaluating success over that short a time period anyway) but over the tenure of your relationship, we believe this to be true.

For more information on the evidence for and basis of this bold statement, Vanguard has done an extensive study on this. The study outlines how an advisor’s value proposition is based on three simple elements: top-down portfolio construction, coaching and wealth management. The essence of the study is that consistent market outperformance is unrealistic and that clients will value—and benefit from – holistic wealth management, which is exactly what we at CrossPoint Financial do for our clients.

What is Discretionary Portfolio Management?

Discretionary portfolio management overcomes the shortfalls of traditional advisory services and reduces costs by delegating the responsibility of the decisions for your investments to our qualified and experienced team utilizing our rigorous investment process.

Most people today are too busy and unable to find adequate time to manage and optimize their investments or simply not comfortable with the responsibility of making the necessary day to day decisions to successfully navigate today’s fast-moving and complex markets. This is where our unique premium discretionary managed program is beneficial as it has been designed to put our resources to work allowing us to efficiently manage your wealth freeing you from the day-to-day “buy-sell” decisions by eliminating discussion for every portfolio transaction. This is similar in nature to the way that you place your trust with a pilot to make ongoing appropriate course corrections, without consultation, ensuring you arrive safely and comfortably to your desired destination with minimal turbulence and delays.

Portfolio Managers differ from mass-market advisors as they have undergone significant additional training and manage larger amounts of money for fewer clients.

Within a structured and disciplined process, our portfolio managers apply the full capabilities of their training to recognize and swiftly implement the complex day-to-day decisions necessary due to ever-changing market conditions and make discretionary adjustments to update your portfolio to ensure that your investments are always in the right place at the right time.

Your portfolio is constructed as uniquely as you, as it is based on personal factors such as growth requirements, income needs, and risk tolerance. Because your approval is not required for every single transaction, your dedicated Portfolio Manager is able to take advantage of investment opportunities quickly and efficiently. We work within specific guidelines established in advance, which are regularly reviewed, adjusted according to your needs and are managed according to the highest industry standards.

In addition, this program provides enhanced regular reporting and will offer you the convenience, confidence, and peace of mind knowing your wealth is being professionally managed. As a result, this service will free your time allowing you to concentrate and pursue your most important business or personal interests while achieving your financial objectives and lifetime family goals.

Investment Philosophy

We manage portfolios under a blend of investments styles: value-investing principles, growth at a reasonable price, and we layer some technical and momentum gauges to ensure we capture the trends the markets are currently rewarding. We utilize a low-cost passive core holding (ETF) within the framework of modern portfolio theory and we layer on “satellite” positions to active managers or individual stock positions to complement this core.

A few key points to help describe our philosophy a little clearer are:

- We believe most investors are relatively risk-averse. The only acceptable risk is that which is adequately compensated by potential portfolio returns.

- Markets are efficient over long periods of time. It is virtually impossible to anticipate the future direction of the market as a whole.

- The design of the portfolio is more important than the selection of any particular security within the portfolio. The appropriate allocation of capital among asset classes (stocks, bonds, cash, real estate, hedging strategies, commodities, etc.) and across various geographies (Canada, US, International, etc.) will have far more influence on long-term portfolio results than the selection of individual securities. Investing for the long term becomes critical to investment success because it allows the long-term characteristics of the asset classes to surface.

- For a given risk level, an optimal combination of asset classes will maximize returns. Diversification helps reduce investment volatility. The proportional mix of asset classes determines the long-term risk and return characteristics of the portfolio.

- Portfolio risk can be decreased by increasing diversification of the portfolio and by lowering the correlation of market behavior among the asset classes selected. (Correlation is the statistical term for the extent to which two asset classes move in tandem or opposition to one another)

- Investing globally helps to minimize overall portfolio risk due to the imperfect correlation between economies of the world. Investing globally has also been shown historically to enhance portfolio returns, although there is no guarantee that it will do so in the future.

- Equities offer the potential for higher long-term investment returns than cash or fixed income investments. Equities are also more volatile in their performance. Investors seeking higher rates of return must increase the proportion of equities in their portfolio, while at the same time accepting a greater variation of results (including occasional declines in value).

- There do exist certain “factors” of return, like value investing (companies that are worth more than their current market price), that over the long-run could provide returns that are in excess of the market itself.

- We utilize Alternative investments to differentiate returns from broad equity and bond markets as they seek to deliver positive returns with little or no correlation to these broad markets.

- We design all model portfolios with ethical and moral filters so that we contribute to doing good and helping guide capital in ways that make our world a better place, one small step at a time. To that end, we have Socially Responsible Investing model portfolios that incorporate ESG (environmental, social and governance) filters for those clients that want their portfolios to align with their personal beliefs. For many on our team, this is an important aspect of our process as it aligns our personal beliefs to how we invest and speaks to our purpose as wealth managers.

Ask Yourself

Have your returns lagged over time? We hear many people say that investing doesn’t work. A good advisor can turn your experience from lagging the markets to capturing what investing has to offer. Ask yourself these questions:

- Is my advisor truly independent or do they represent certain products?

- Is my advisor a fiduciary?

- Is my advisor a discretionary portfolio manager?

- Are the interests of my advisor aligned with my own?

- What are my advisors’ credentials?

- Besides managing money, what else does my advisor do for me?

Your Due Diligence is Essential

We highly recommend that you do your due diligence when seeking an advisor.

The Investment Industry Regulatory Organization of Canada (IIROC) makes information about every advisor available for the general public to review. Click the Know your Advisor logo above and scroll to the bottom of the page and press the “Start Search” button.