Greetings! Please allow me to take a brief walk down memory lane with you.

Many of you know about my early days as an advisor, but as our firm has grown, I suspect many of you may not. Initially, I wasn’t interested in this field at all—until I realized the intellectual puzzle it presented, combined with the opportunity to engage with real people’s lives, their hopes, dreams, and fears. I fell in love with this work in my early 20s.

That said, I began my university studies in Engineering, then shifted to Computer Science, spent a short time in Mathematics, and eventually landed in Business and Finance to pursue my passion for investing and helping people. My parents always encouraged me to keep exploring and to step through the doors that opened along the way. They’d often say, “Go for it—just don’t stop or move backwards.” I appreciated that advice then and even more so now, as a parent myself.

I remember in my Computer Science courses, we learned that the simplest code was often considered the most elegant—achieving the desired result with the least complexity. We always strived for that. My dad, a Waterloo graduate and computer coder in COBOL and other languages, wholeheartedly agreed: simple and clean was the elegant solution.

I recently came across a note from Carl Richards, a well-known advisor and commentator in the U.S., and it resonated deeply with me—both personally and professionally. I wanted to share it with you, as it may apply to your situation as well

From Carl Richards:

“There’s this old mountaineering strategy called siege style.

You drag everything up the mountain: extra oxygen, fixed ropes, backup boots, food for weeks, a team of porters.

It works. But it’s heavy. Slow. Complicated. Sometimes, it leaves a mess.

Then came a new idea: alpine style.

What’s the minimum amount of gear we can bring and still make it to the top?

It’s lighter. Faster. Riskier, maybe.

But the quality of the experience? Higher. Way higher.

So here’s my question:

Are we climbing our financial mountains using siege style or alpine style?

Because all that extra stuff—bank accounts you forgot about, old investment logins, tools you don’t use, subscriptions you meant to cancel—can start to get in the way.

It feels productive until it doesn’t.

At some point, the stuff stops adding value and starts subtracting from the experience.

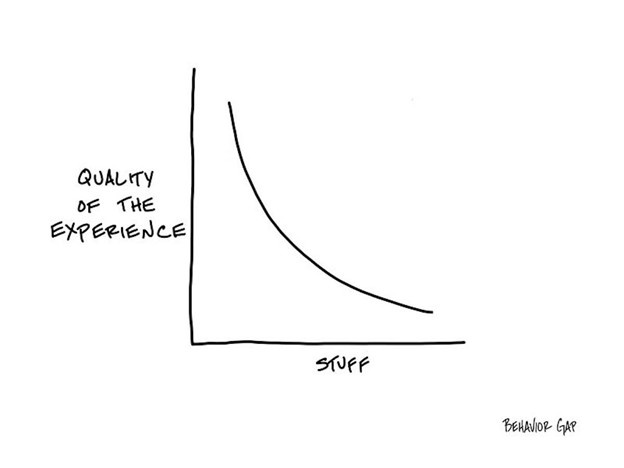

This sketch is just a simple downward sloping line:

More stuff = Lower quality of experience.

And if I’m honest?

Sometimes I look at my own financial setup and think…

“I might be dragging too much up the mountain.”

If this message resonates with you, I’d encourage you to reach out to your CrossPoint advisor to start a conversation about consolidating your accounts and portfolios with us—simplifying your overall financial picture and plans as much as possible. We’d love to help you design the most elegant solution for your situation.

And if you’ve already achieved this simplicity, and we’ve played a role in that process, we couldn’t be happier! We’d also be grateful if you shared this with friends or family who might benefit from our help.

We’re here to help and to serve.

Kindest regards,