Portfolio Highlights

Shares of Alphabet Inc. (GOOG) advanced 13.90% in September following news that the U.S. Department of Justice would not require the company to divest its Search division. Investors responded positively, driving a notable rally in the stock. Alphabet continues to demonstrate progress across key growth areas, including its Gemini AI platform, cloud computing, and autonomous vehicle technology.

Transalta Corporation (TA) extended its strong performance, rising 12.69% over the month and remaining a standout contributor within the portfolio. The company continues to transition its energy production toward renewables and is well positioned to become a leading power provider for data centres across Canada.

CRH plc (CRH), a global leader in building materials such as cement, asphalt, and concrete, gained 7.57% in September. The company has been among the top performers over the past two years, supported by sustained infrastructure investment. Our initial thesis around increased government infrastructure spending continues to unfold, with CRH benefiting as one of the largest recipients of funding under the U.S. infrastructure act and a major builder of roads nationwide.

Shares of Metro Inc. (MRU) declined 4.69% as the consumer staples sector faced continued headwinds from tariff pressures. Recently, the grocer implemented price increases on approximately 3,000 products to preserve margins, which has dampened demand. The stock’s weakness appears to be driven by sector-wide challenges rather than company-specific issues. Metro maintains a strong market position in Quebec, and has solid growth prospects in their Pharmacy division. The recent fall in the stock price comes on the back consecutive higher-than-expected earnings reports which led to strong performance. The company is likely in a healthy consolidation period.

All data sourced from FACTSET and Bloomberg L.P.

All data is for the reported month and in local currency.

Macro Watch

- The recent government shutdown has had minimal impact on equity markets; however, continued disruptions of this nature could begin to pressure stocks trading at elevated valuations.

- Analysts suggest we may be entering an early phase of growth driven by automation rather than labour expansion, as corporate profits remain strong despite slowing job growth. Rising bond yields and a threat of stagflation remain key risks to monitor.

- OPEC’s continued increase in production has placed downward pressure on oil prices. Given the energy sector’s close correlation with crude, some softness in the sector may persist over the medium term.

All data sourced from FACTSET and SIACharts.

All data is for the reported month and in local currency.

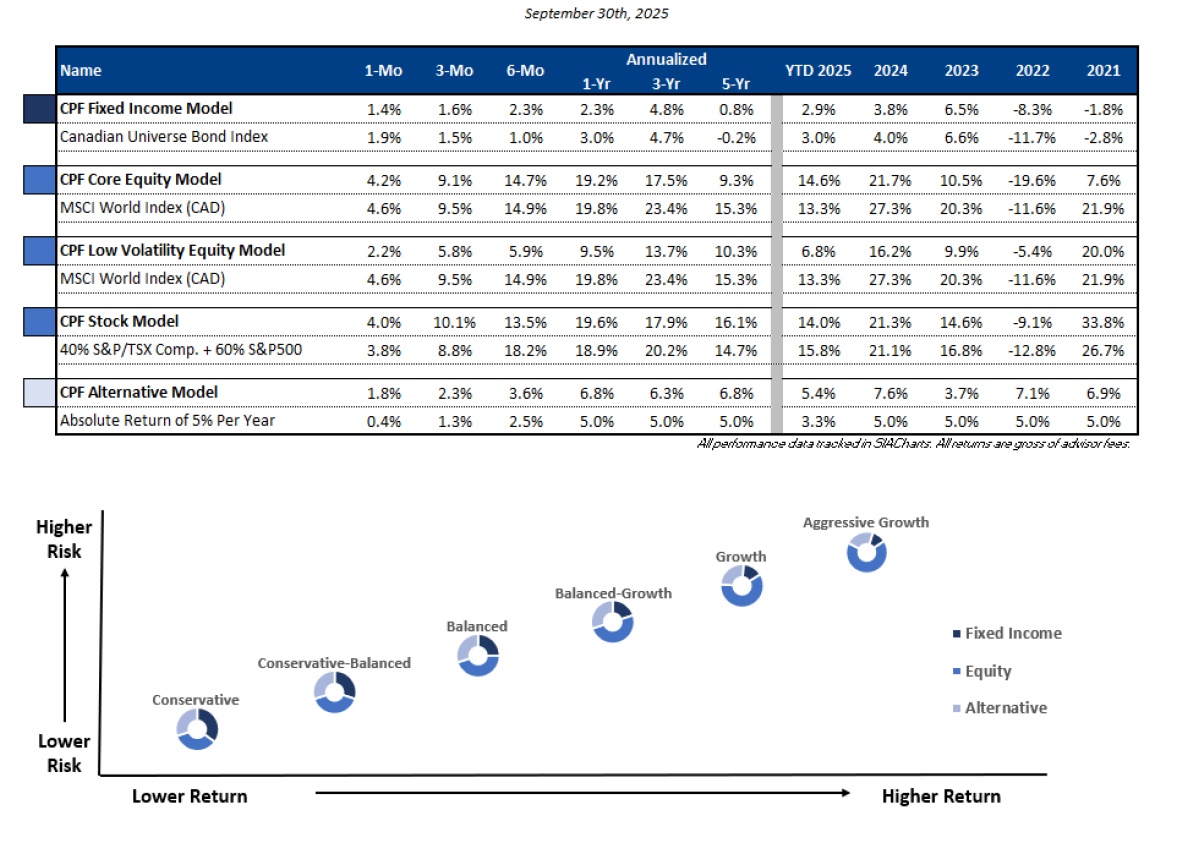

Portfolio Returns

September 2025