Portfolio Highlights

Shares of Dollarama (DOL) rose 9.68% in November. The retailer continues to benefit from strong demand for affordable goods, as concerns about persistent inflation are leading consumers to seek lower-cost alternatives—supporting consistent sales growth. As the lowest-cost provider of everyday essentials, Dollarama’s customer base is generally resilient, even in the face of meaningful price increases.

TransAlta Corp. (TA) fell 18.03% in November. Regular readers will recognize that TransAlta appears often in our commentary due to its inherent volatility. This volatility is closely tied to its exposure to AI infrastructure and the broader data-center build-out theme. Developments related to AI or energy infrastructure can meaningfully move the stock. We continue to value TransAlta for the indirect exposure it provides to the data-center theme without investing directly in AI equities. Despite last month’s decline, the stock remains up approximately 30% year-over-year.

Alphabet Inc. (GOOG) has continued its strong momentum in the final quarter, gaining 13.40% in November. The company recently launched Gemini 3, which has received highly positive feedback from technology leaders regarding its capabilities and performance. In addition, reports that Meta is considering buying or leasing Alphabet’s chips signaled to investors that Alphabet’s hardware is competitive and could threaten Nvidia’s market share. Alphabet remains a well-diversified conglomerate and continues to demonstrate leadership across multiple innovative segments.

Shares of Microsoft (MSFT) declined 5.38% in November. Unlike Alphabet, Microsoft has faced growing investor concern regarding the scale of its AI-related spending and the pace at which AI software is being adopted. Many fear that adoption is progressing more slowly than expected, raising questions about long-term returns on investment. While we remain confident in Microsoft as a proven and well-diversified business, we—like many investors—are closely monitoring the company’s long-term capital expenditures related to AI initiatives.

All data sourced from FACTSET and Bloomberg L.P.

All data is for the reported month and in local currency.

Macro Watch

- The U.S. Federal Reserve cut rates again in November, highlighting growing concerns about a weakening labour market. Markets are now pricing in additional cuts before year-end, with even more expected in 2026.

- Bitcoin fell 17.5% in November, and the broader crypto market experienced one of its weakest months in years. The decline reflects selling pressure driven by softer sentiment toward risk-on assets and a shift by some money managers toward higher cash allocations.

- While the U.S. appears poised for more aggressive easing, the Eurozone is seeing inflation stabilize near its 2% target. Many geopolitical strategists believe the region is nearing the bottom of its rate-cutting cycle, though growth is still expected to remain subdued as financial conditions stay tight.

All data sourced from FACTSET and SIACharts.

All data is for the reported month and in local currency.

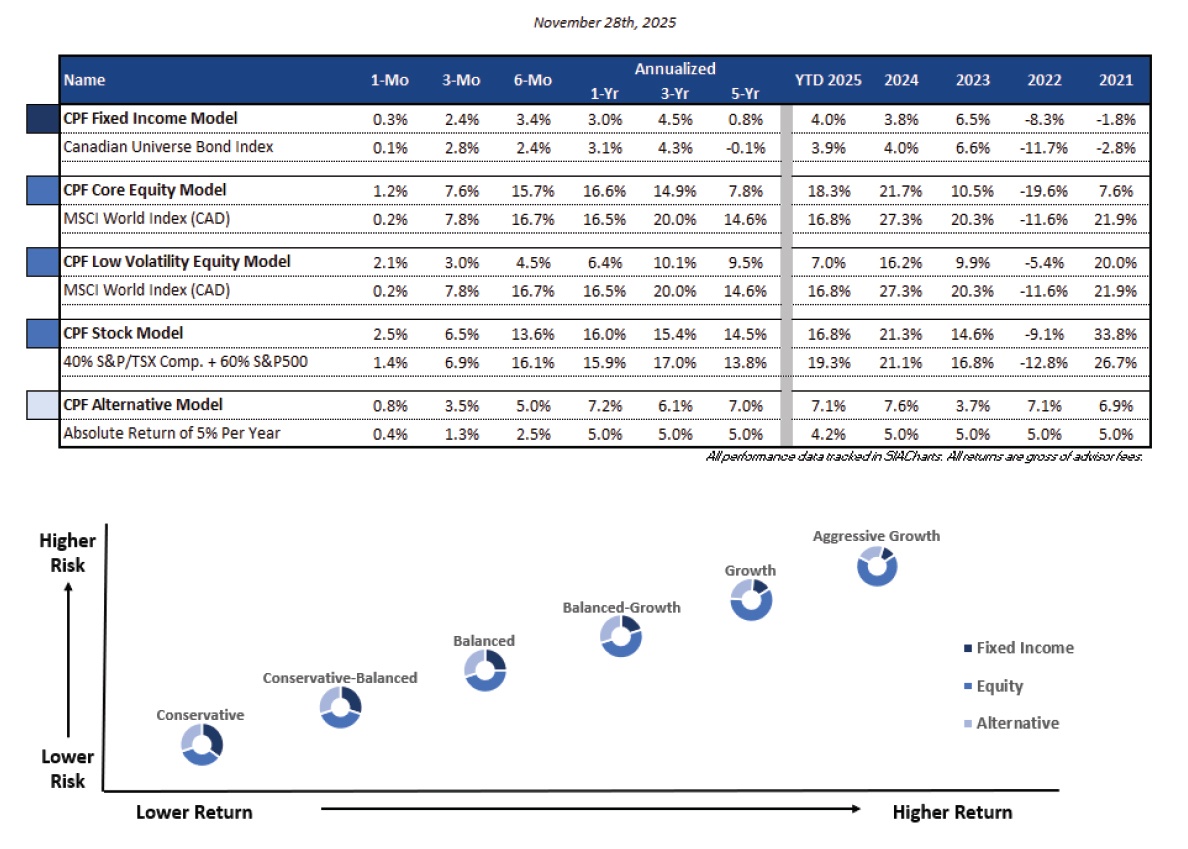

Portfolio Returns

November 2025