Market Pulse

The Canadian economy displayed unexpected strength in early 2024, with notable GDP growth in the first two months driven by sectors like oil and gas, manufacturing, and finance. This robust start, marked by the highest growth since early 2022, tempers the urgency for immediate interest rate cuts by the Bank of Canada. Although the economy’s expansion exceeded forecasts, it’s attributed more to easing supply constraints than a rise in demand, suggesting potential for gradual rate reductions ahead. Meanwhile, demographic adjustments and government policies on temporary residency are poised to influence future economic dynamics. Despite the positive short-term indicators, underlying per-capita GDP trends and inflation rates will be key factors in the central bank’s forthcoming monetary policy decisions.

Carolyn Rogers of the Bank of Canada emphasized the need to boost Canada’s lagging productivity to achieve sustainable economic growth without triggering inflation. She identified underinvestment and limited competition as key barriers. Rogers proposed enhancing workforce skills, increasing competition to drive efficiency, and addressing the persistent underinvestment in capital and technology as solutions. This approach aims to improve job quality and wages without exacerbating inflation, offering a strategic path forward amid ongoing economic challenges.

The Swiss National Bank (SNB) unexpectedly cut its key interest rate by 25 basis points to 1.5%, aiming to mitigate the Swiss franc’s strength. This move, surprising many, weakened the franc significantly against major currencies. The decision reflects a strategic preference for using interest rate adjustments over foreign exchange interventions to guide economic outcomes. The rate cut, justified by effective inflation control, puts the SNB ahead of similar actions by global counterparts, like the Bank of Canada or US Federal Reserve.

The rapid rise of US stocks in 2024, with the S&P 500 hitting multiple record highs and significant gains in tech stocks like Nvidia, has raised bubble concerns. However, signs of a more measured market emerge from the mixed performance of major tech stocks, broad participation beyond tech sectors, and cautious investor response to IPOs. Current valuations, though high, are not at the extreme levels seen in past bubbles, suggesting the rally might be underpinned by solid fundamentals rather than speculative excess. This mix of factors indicates a potentially more stable market environment.

All data sourced from FACTSET and SIACharts.

All data is for the reported month and in local currency.

The Ups & Downs

- Shares of Alphabet Inc. (GOOG:US) rose 8.84% as growth stocks continue to be key contributors to market growth.

- JPMorgan (JPM:US) was up 7.71% as macroeconomic sentiment and company fundamentals are producing tailwinds.

- BCE Inc. (BCE:CA) shares dropped 6.67% in March due to the company announcing significant layoffs and a weak 2024 outlook.

- TransAlta Corp (TA:CA) fell 6.66% as the company battles debt management and commodity price fluctuations.

All data sourced from FACTSET and SIACharts. All data is for the reported month and in local currency.

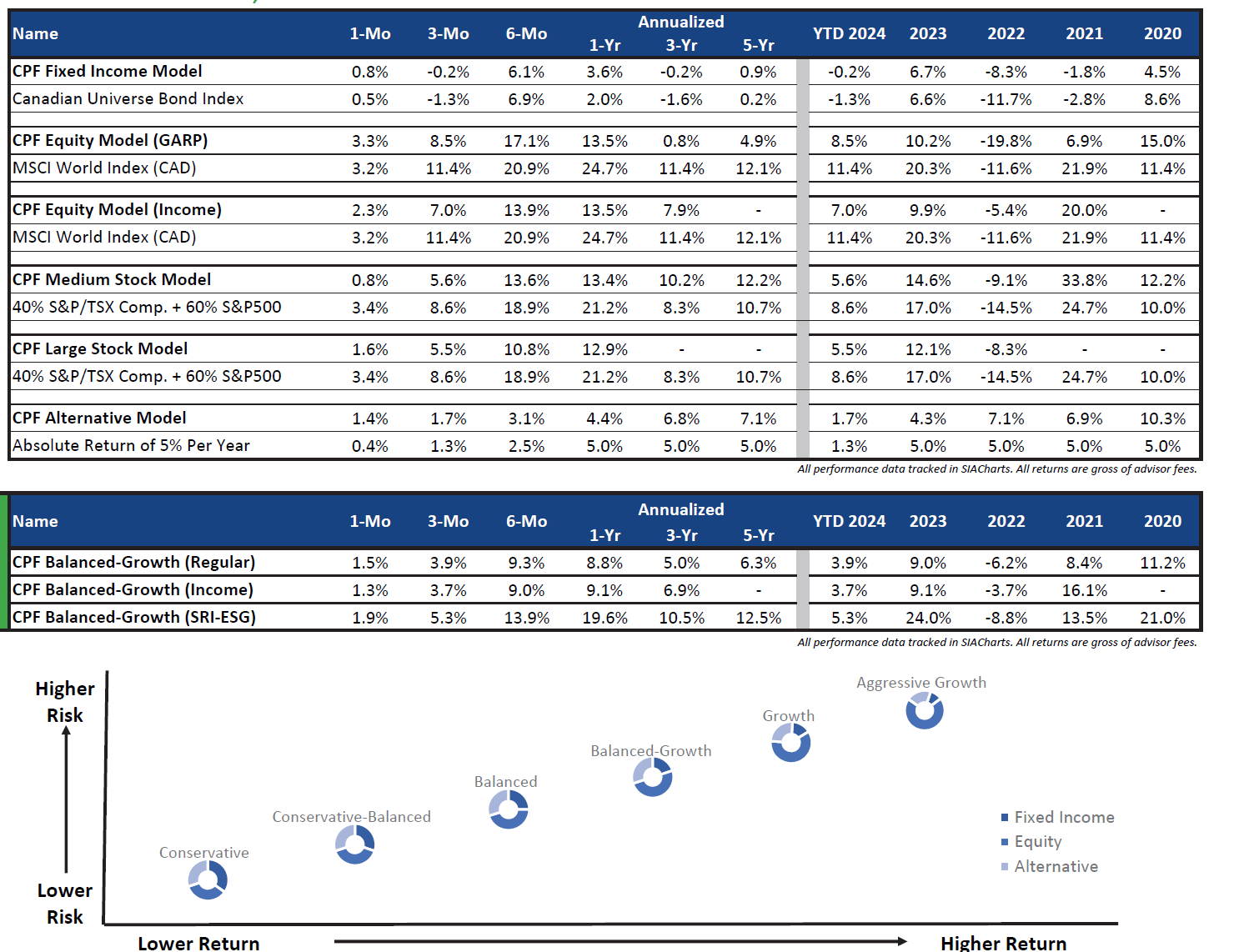

Portfolio Returns

As of March 31st, 2024