Equity Rebound Amid Tightening Financial Conditions

March 2022 Commentary & Performance Review

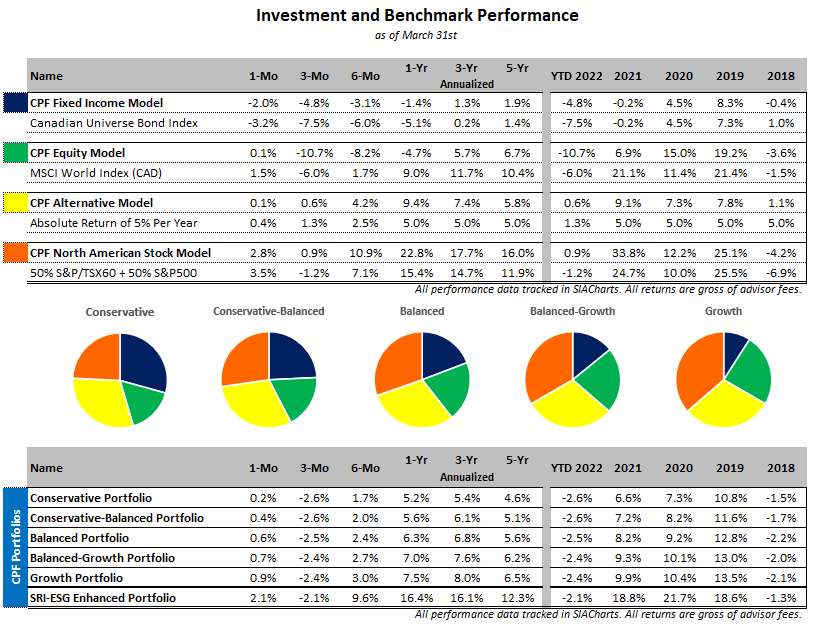

Equity markets recovered after a precipitous drop through February, with both the S&P 500 and S&P/TSX rising. However, fixed income securities struggled to hold value as high inflation readings raise the potential for a more hawkish approach by central banks. Yield curves of varying length on both U.S. and Canadian Treasuries inverted at different times throughout the month, although their efficacy at predicting a recession has come into question.

The price of Brent crude oil spiked as sanctions began to take effect on Russian supply, nearing prices last seen in 2012. When prices last surged to these levels 10 years ago, strong U.S. job growth, low interest rates, and increased Chinese manufacturing activity coupled with supply disruptions from sanctions linked to the Iran nuclear program were the primary causes.

Statistics Canada reported that the ratio of household debt to disposable income reached a record level in the fourth quarter of 2021. On a seasonally adjusted basis, household debt stood at 186.2% of disposable income, higher than the 2019 pre-pandemic ratio of 181.1%. The agency cited higher mortgage borrowing costs and lower disposable incomes as the catalysts.

Our position in Tourmaline Oil gained 15.2% after reporting exceptionally strong earnings and riding the wave of higher energy prices. The company reported record annual profits of CA$2 billion in 2021, with nearly half of the profits generated in the fourth quarter alone. The record profits of oil producers have drawn political scrutiny as they haven’t been quick to increase production and therefore lower energy prices, and this is having a meaningful impact on consumers and headline inflation readings.

As the summer approaches, you may be looking to travel or make other large expenditures as things “open up” again. To allow us the opportunity to efficiently withdraw any required funds from your investments, we ask that you notify us as early as possible. The sooner we’re advised of large upcoming expenses, the better we can navigate markets to withdraw the funds without impacting your long‐term financial goals.

Portfolio Contributors

- Shares of Tourmaline Oil gained 15% amid higher energy prices.

- Nutrien Ltd jumped 19% as geopolitical conflict disrupts fertilizer production and exports from Russia, a major global producer.

Portfolio Detractors

- Steadfast Income Fund fell 2% as fixed income markets continue to adjust to hawkish central banks and tapering of stimulus programs.

- Verizon Communications shares fell 5% after terms of a deal with the U.S. Department of Defense failed to meet investor expectations.

All returns are for the reported month and in local‐currency.

All data sourced from SIACharts and FACTSET.