Portfolio Highlights

Units of Granite REIT (GRT.UN) rose 7.88% in January, supported by its consistent monthly distributions, which reflect stable cash flows. During the month, the REIT announced $292M in acquisitions and $190M in dispositions, reinforcing a disciplined approach to capital allocation.

Abbott Laboratories (ABT) had a disappointing start to the year, finishing January down 13.03%. The decline followed its quarterly report, where the medical device manufacturer fell short of revenue estimates. Combined with cautious first-quarter 2026 earnings guidance and weakness in the Nutrition segment, the results led to a double-digit drop post-earnings. While the company has historically demonstrated strong growth and resilience, we will continue to monitor the stock closely.

Procter & Gamble (PG) gained 6.06% in January after an extended period of share price weakness. The company reported earnings during the month, surpassing EPS estimates and maintaining guidance for both sales growth and earnings despite ongoing headwinds. Management also highlighted upcoming innovations expected to support operational performance over the next six

months.

Shares of Microsoft Corp (MSFT) declined 11.10% in January, driven by moderate growth in its Cloud (Azure) segment. Slowing expansion in this high-margin business concerned investors, and the stock fell more than 10% following earnings. Sentiment has also shifted around AI-related spending, with growing questions about whether the technology can generate sufficient returns to justify substantial investment. Microsoft, however, continues to invest aggressively in this area.

All data sourced from FACTSET and Bloomberg L.P.

All data is for the reported month and in local currency.

Macro Watch

-

Gold prices experienced heightened volatility in January as markets responded to ongoing geopolitical uncertainty. Periods of elevated global tension typically drive investors toward safe-haven assets such as gold, contributing to short-term price fluctuations. After strong buying pressure early in the month, prices corrected sharply toward month-end. The price of Gold still gained 12.4% in January.

-

The International Monetary Fund (IMF) released its 2026 global outlook, projecting low-to-moderate economic expansion. Growth is expected to be uneven, concentrated in select regions, with emerging markets anticipated to outpace developed economies. This view has been broadly echoed by the World Bank and several private institutions, including Deloitte and Morgan Stanley, reinforcing expectations of mixed regional

performance. -

In its January 2026 Monetary Policy Report, the Bank of Canada indicated that inflation is expected to remain close to its 2% target, while maintaining the policy rate at 2.25%. Although opinions among economists remain divided, some anticipate the possibility of rate increases later this year or into 2027. Future policy decisions may also be influenced by the outcome of trade agreement negotiations between Canada, the United States, and Mexico scheduled for July.

All data sourced from FACTSET and SIACharts.

All data is for the reported month and in local currency.

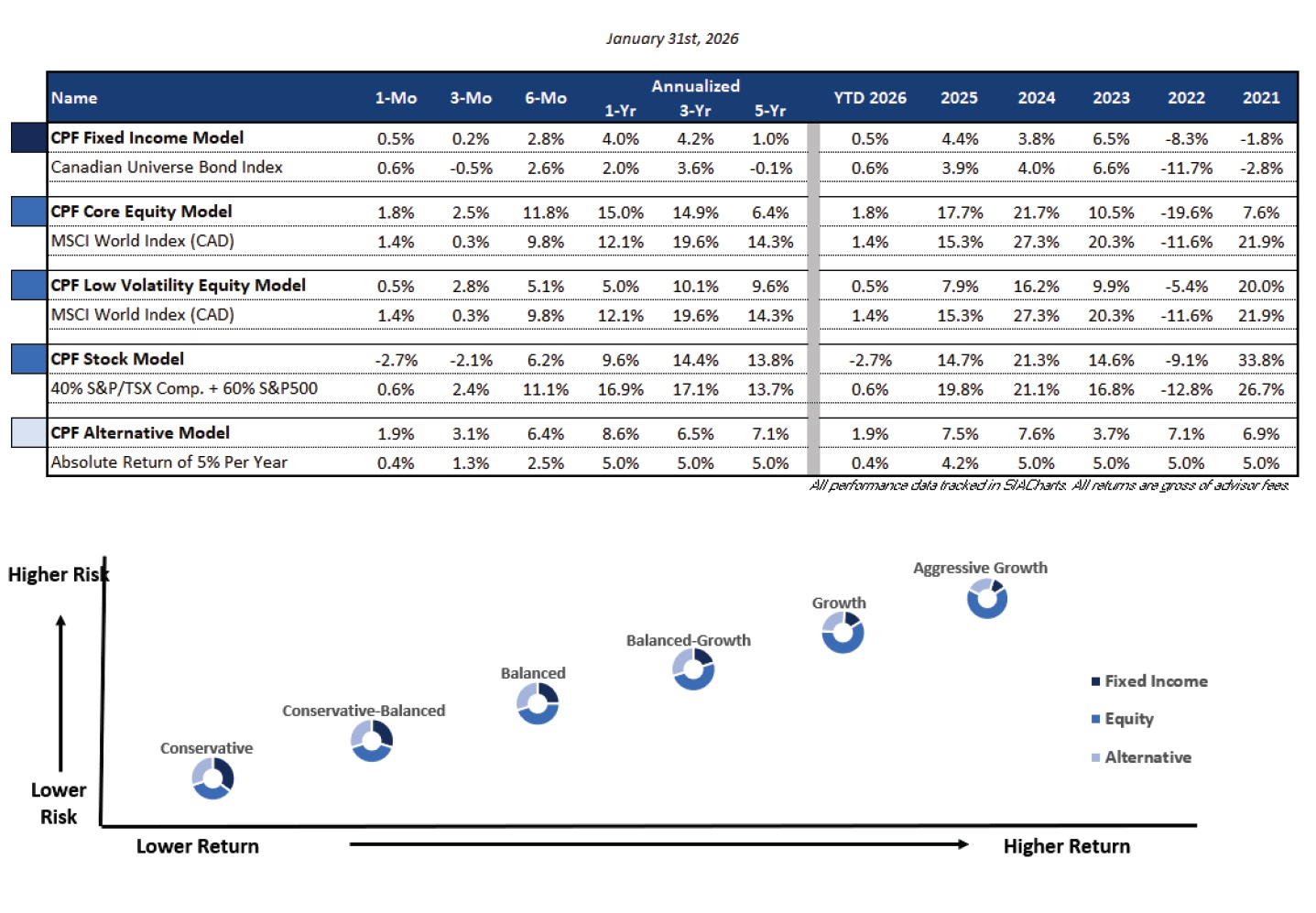

Portfolio Returns

January 2026