Portfolio Highlights

Shares of TransAlta Corporation (TA) extended their strong performance in October, gaining 30.41% for the month. The rally followed reports that Meta (META) is nearing an agreement to develop new data centers in Alberta. Although TransAlta is not directly involved in the project, the company stands to benefit indirectly as one of the province’s primary power providers. This development highlights Alberta’s growing appeal as a strategic location for large-scale technology and AI infrastructure, potentially attracting further investment from other major tech companies.

Waste Management Inc. (WM) declined 8.95% in October following a Q3 miss on both revenue and earnings. Management attributed the shortfall to weaker recycled commodity prices and lower contributions from the healthcare solutions segment. While these challenges weighed on short-term performance, long-term investors may take comfort in the company’s continued strength in its core waste collection and disposal operations. The headwinds appear to stem from external market factors rather than underlying operational weaknesses.

Alphabet Inc. (GOOG) continued its strong momentum in October, advancing 15.56% for the month. Ahead of its earnings release, the company benefited from favorable regulatory developments, robust demand in cloud computing, and accelerating progress in artificial intelligence. Earnings results reinforced investor optimism, as Alphabet exceeded growth expectations across key segments and remains attractively valued compared to other “Magnificent Seven” peers. Year-to-date, the stock has delivered an impressive 45.22% gain.

Shares of Enbridge Inc. (ENB) fell 6.85% in October as analysts pointed to valuation concerns, suggesting the stock may be trading at a premium relative to peers given the inherent risks in its business model. These risks include significant capital expenditures and sensitivity to commodity price fluctuations. However, the recent pullback follows record highs earlier in the year, indicating the decline is more likely a healthy valuation reset than a sign of deteriorating fundamentals.

All data sourced from FACTSET and Bloomberg L.P.

All data is for the reported month and in local currency.

Macro Watch

- The recent government shutdown has had minimal impact on equity markets; however, continued disruptions of this nature could begin to pressure stocks trading at elevated valuations.

- Analysts suggest we may be entering an early phase of growth driven by automation rather than labour expansion, as corporate profits remain strong despite slowing job growth. Rising bond yields and a threat of stagflation remain key risks to monitor.

- OPEC’s continued increase in production has placed downward pressure on oil prices. Given the energy sector’s close correlation with crude, some softness in the sector may persist over the medium term.

All data sourced from FACTSET and SIACharts.

All data is for the reported month and in local currency.

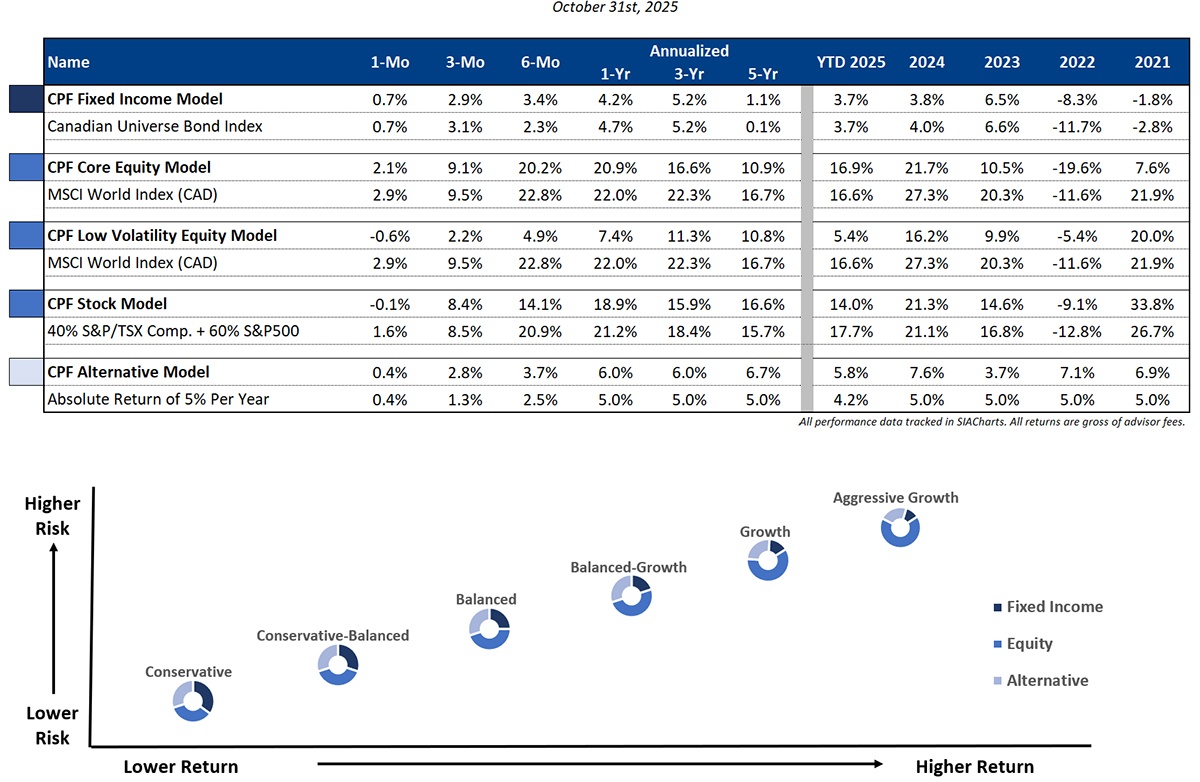

Portfolio Returns

October 2025