Market Pulse

The global economic outlook for 2024 presents a paradox of resilient growth amid escalating risks. While some economies are defying expectations of recession and showing signs of robustness, the broader picture is marred by deepening geopolitical tensions and a more fragmented world. The IMF is set to upgrade its growth forecasts for major economies, reflecting a tentative optimism with global growth projected at 2.9%. However, high levels of debt, particularly in poorer nations, are limiting their economic potential, while technological and geopolitical shifts threaten to concentrate economic gains in wealthier countries.

Four months into his term, Argentine President Javier Milei has notably stabilized the peso, achieving a 25% gain against the dollar. Milei’s aggressive fiscal policies, including substantial government spending cuts, have curbed inflation but also deepened the recession and heightened unemployment, creating political pressures. Although the peso’s purchasing power has improved, ongoing high inflation could undermine these gains, threatening export competitiveness and reducing tourist inflows.

Alphabet Inc. surpassed first-quarter revenue expectations, boosted by robust growth in its cloud computing unit. The company also announced its first-ever dividend and plans to buy back US$70 billion in stock. Despite challenges in maintaining its dominance in search due to new AI-driven competition from companies like OpenAI and Microsoft, Alphabet’s cloud and search advertising revenues have shown strong performance. Meanwhile, YouTube has rebounded with significant revenue growth attributed to strategic investments in live sports, ad blocking crackdowns, and Shorts.

Canadians are increasingly optimistic about housing, with nearly half (48%) anticipating an increase in real estate values in their neighborhoods over the next six months. This marks the most significant margin of optimism since May 2022, shortly after the Bank of Canada began hiking interest rates. This current sentiment contrasts with only 8% expecting declines, showcasing the highest confidence in property prices since 2008, if the anomalous pandemic years of 2020 to 2022 are excluded.

Cocoa prices plummeted by as much as 27% over two days, marking the most significant drop on record, after reaching a peak of over $11,000 per ton earlier in the month due to a supply shortage. This volatility has been fueled by reduced liquidity, as higher costs led investors to close their positions. Despite the sharp decline, fundamental supply issues persist, with poor harvests in West Africa contributing to ongoing supply deficits.

All data sourced from FACTSET and SIACharts.

All data is for the reported month and in local currentestcy.

The Ups & Downs

- Shares of Dollarama (DOL:CA) jumped 11.38% this month after management expressed strong confidence on future growth in their year-end report.

- Shares of Alphabet Inc. (GOOG:US) continued to climb another 8.13% in April after reporting Q1 YOY revenue growth of 15%. The company also announced a $70 billion share buyback plan.

- Johnson & Johnson (JNJ:US) shares dropped 8.60% in April after coming under fire for contaminated children’s cough syrup. JNJ has recalled the bad batch and is currently working with health authorities.

- Shares of Nucor Corporation (NUE:US) plummeted 14.84% after the company reported worse-than-expected quarterly results on April 22nd.

All data sourced from FACTSET and SIACharts. All data is for the reported month and in local currency.

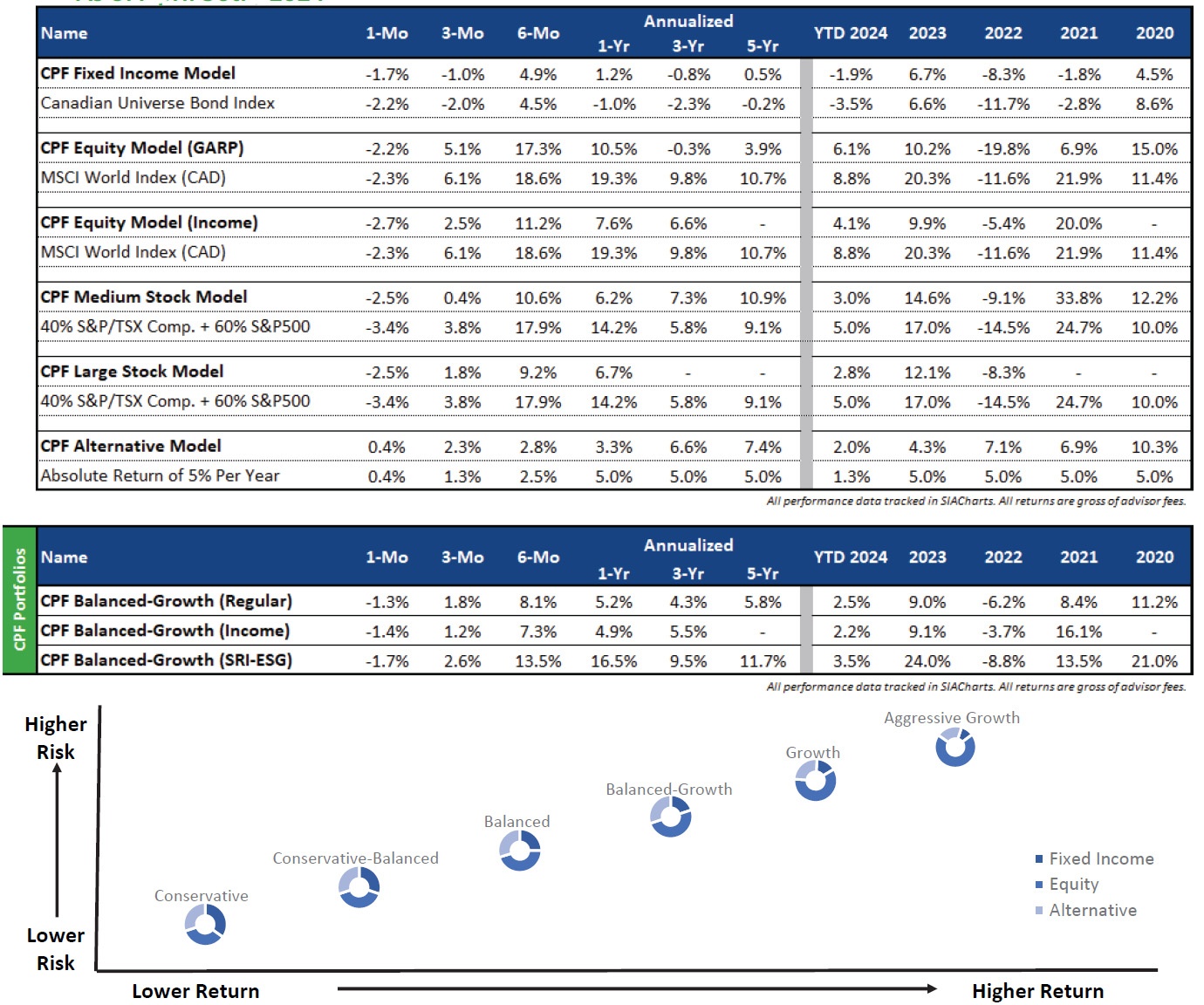

Portfolio Returns

As of April 30th, 2024