Market Pulse

Global equity markets extended their rebound from April’s lows, buoyed by strong corporate earnings and easing geopolitical tensions. The S&P 500 advanced 3.83% in May, led primarily by strength in the “Magnificent Seven” technology and AI-related stocks. In Canada, the S&P/TSX Composite Index gained 5.37%, supported by stabilizing commodity prices and a robust rally in the financial sector, where major banks posted near double-digit returns.

In the U.S., food inflation, which had bottomed in August 2024, is beginning to trend upward once again. Historically, U.S. food inflation tends to lag the UN’s global food price index by approximately nine months. Notably, global food prices have posted eight consecutive months of positive growth, reaching 9% year-over-year in April. This trend adds complexity for the Federal Reserve, which must weigh the inflationary impact of rising food prices alongside the delayed effects of recently implemented tariffs.

First-quarter corporate earnings in the U.S. suggest consumer resilience, with little immediate evidence that policy uncertainty has weighed on profit margins. That said, analysts have revised earnings guidance downward for the second quarter and full year 2025—particularly in sectors with greater exposure to trade policy. Executive sentiment remains cautious, with concerns around a potential recession persisting. Elevated discretionary spending among higher-income households may be obscuring broader economic vulnerabilities, especially among average consumers.

In Canada, the labour market shows signs of considerable strain. March employment data reflected a sharp decline, continuing February’s weakness. The evidence increasingly points to a recession, with pronounced job losses in interest rate-sensitive sectors such as Real Estate, Construction, Retail, and Financial Services. The Discretionary-sector employment has also contracted for three consecutive months, a typical signal of mounting financial stress. The national unemployment rate has risen to 6.9%, up from 5.1% just two years ago, reinforcing the case for monetary policy easing.

Amid concerns of a maturing U.S. equity rally and growing macroeconomic uncertainty, investors have increasingly turned to alternative assets. While Bitcoin has attracted attention as a speculative hedge, physical gold may offer more enduring advantages in the current environment. Gold has historically outperformed the S&P 500 during periods of economic slowdown or recession, and demand is likely to remain robust as central banks continue to diversify reserves away from the U.S. dollar.

All data sourced from FACTSET and Bloomberg L.P.

All data is for the reported month and in local currency.

The Ups & Downs

- Microsoft Corp. (MSFT) surged 16.84%, supported by accelerating cloud growth, strong Azure performance, and robust demand for AI-driven products.

- Granite REIT (GRT.UN) rose 11.61% after reporting strong FFO growth and benefiting from stable interest expenses and favorable FX tailwinds.

- Berkshire Hathaway (BRK) fell 5.79% in May as investor caution grew around slower equity gains and insurance segment moderation.

- Apple Inc. (AAPL) declined 5.41%, pressured by weaker wearables revenue, gross margin compression, and rising legal and tariff risks.

All data sourced from FACTSET and SIACharts.

All data is for the reported month and in local currency.

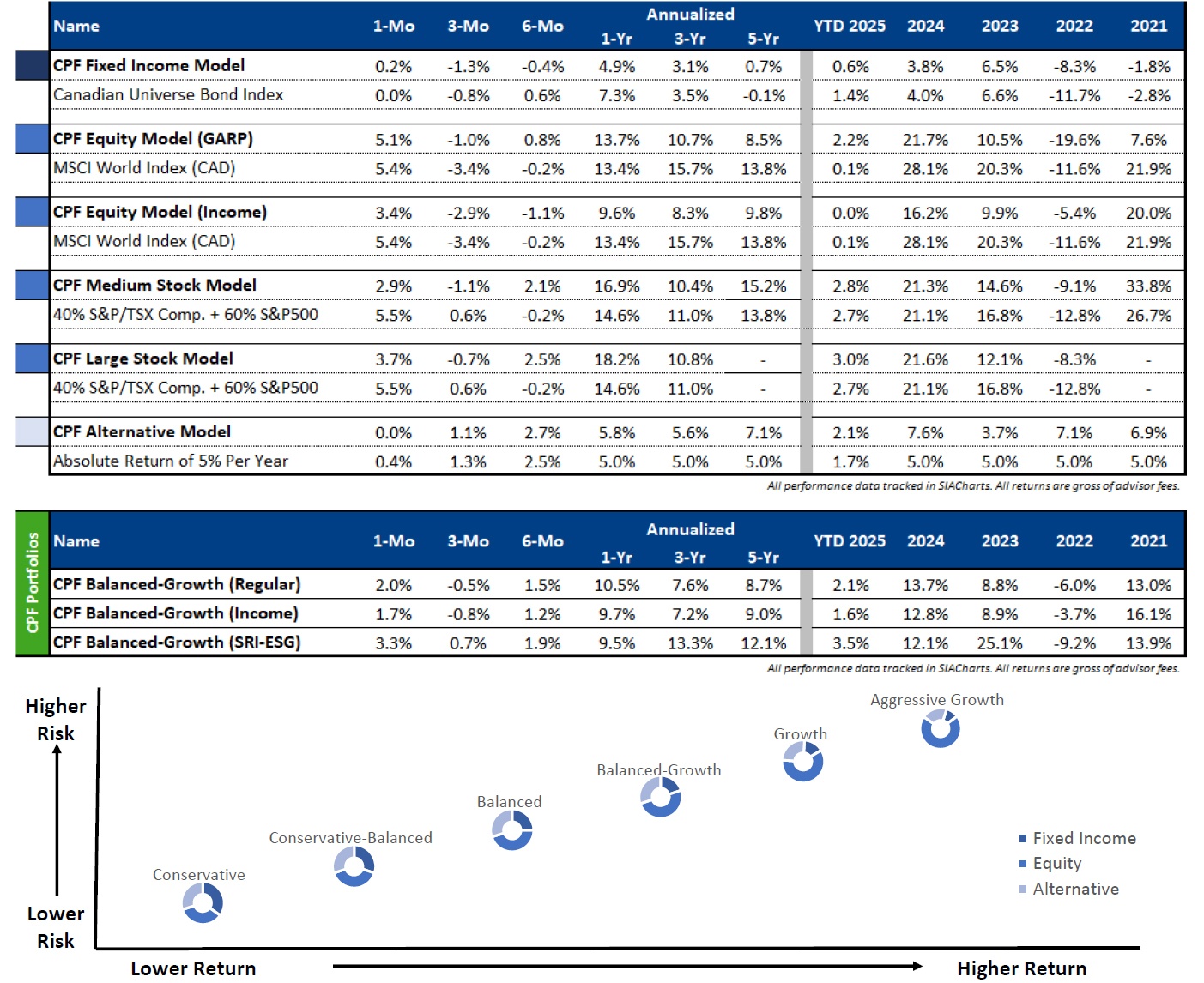

Portfolio Returns

As of May 31st, 2025