New Industries and Old

Jeff Bezos, who founded Amazon in 1994 as an online bookstore, has left the position of CEO after amassing a nearly $200 billion fortune. Bezos will continue to serve on the board of directors while also pursuing his interest in space exploration through his company Blue Origin. Andy Jassy will be taking the helm at Amazon after leading the development of their extremely successful cloud computing division. Amazon Web Services constitutes the lion’s share of the company’s profits and is expected to be the main driver of future growth.

The Organization of Petroleum Exporting Countries (OPEC) and their allies have reached an agreement to eliminate production cuts by September 2022. As global demand for oil has recovered, prices for the commodity have surged. The group of exporters, referred to as OPEC+, will begin raising production in August and will increase output until the imposed production cut of 5.8 million barrels per day is completely phased out. The increased output should help alleviate some of the inflation pressure consumers are experiencing in energy prices.

After hitting a post‐pandemic high in March, yields on U.S. 10‐year Treasury Notes have started to trend lower. During the month, yields went as low as 1.18, 20% lower than where they started the month, and may be a signal that the U.S. economy has hit peak growth for this cycle and that inflation fears are subsiding. While the U.S. recovery has been robust, Canada’s economic growth has been closer to trend at a forecasted 2.5% annualized rate. With high vaccination rates and the lifting of COVID restrictions, estimates are for Canada’s growth to continue strong into 2022.

Robinhood, the online brokerage that helped spur the meme stock phenomenon, began trading its shares publicly on July 29th. Their IPO was atypical given the size of the allotment set aside for Robinhood users. Usually when a company goes public, the bulk of shares are sold to institutional investors with a mandated lock‐up period, with only 1%‐2% being sold to retail investors. This is meant to provide stability to the share price once trading begins. Robinhood instead chose to offer up to 35% of the new shares directly to their customers, which may have contributed to the bout of high volatility on opening day.

Portfolio Contributors

- iShares Global Water ETF (CWW) gained 7.25%, partially driven by the advancement of the U.S. infrastructure bill that includes clean water initiatives.

- Vanguard Information Technology ETF (VGT) added 3.37% as sentiment shifted back towards growth‐oriented stocks.

Portfolio Detractors

- iShares Global Clean Energy ETF (ICLN) fell 3.20% for the month as clean energy stocks continue to lag after a strong performance in 2020.

- ARKK Innovation ETF (ARKK) gave up 8.24% after gaining nearly 20% the month prior. After the surge in June, shares were overbought.

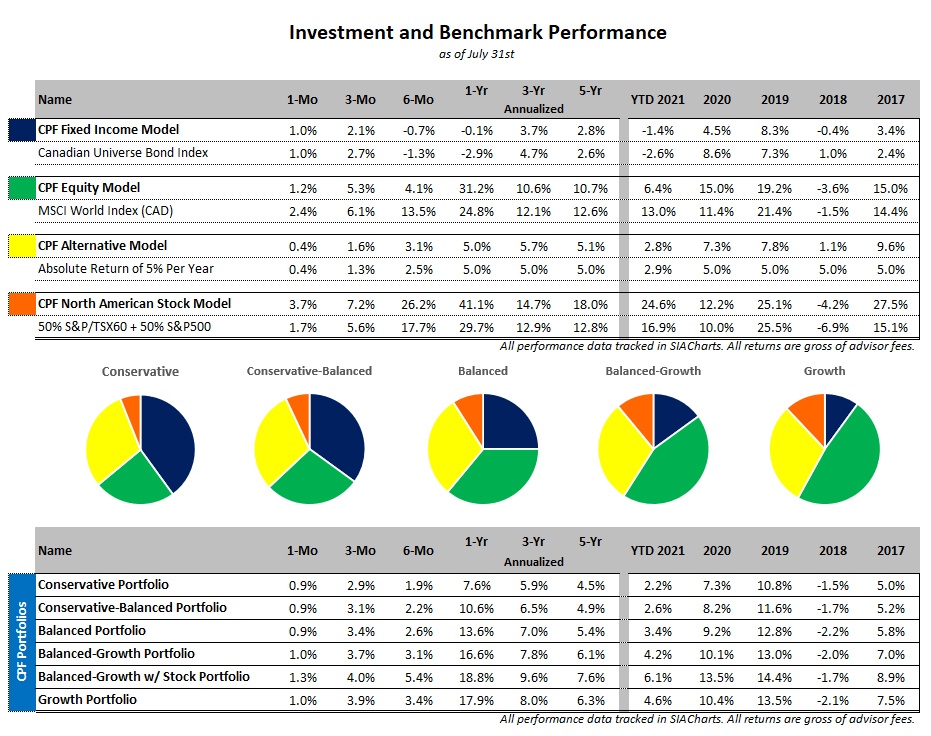

All data sourced from SIACharts and FACTSET.

- Canadian Universe Bond Index: iShares Canadian Universe Bond Index EFT (XBB.TO)

- MSCI World Index (CAD): iShares MSCI World Index EFT (XWD.TO)