Bad News is Good News

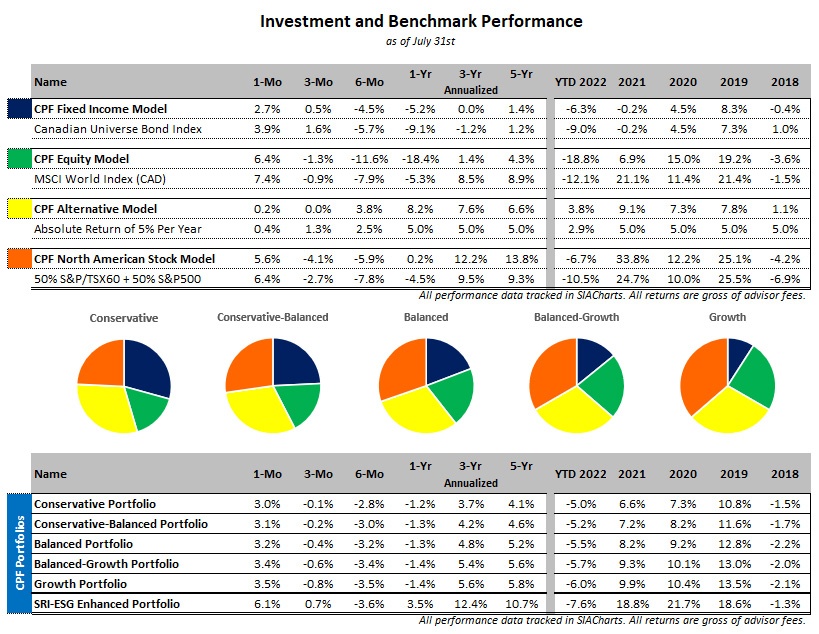

July 2022 Commentary & Performance Review

North American equity markets moved higher during the month, contrary to disappointing economic data. Despite the US having negative GDP growth in the second quarter (Canada does not announce until the end of August), both major indices finished higher. Any recession will be determined officially by the National Bureau of Economic Research in hindsight, although equity markets appear to already be adjusting for a decline in corporate earnings. Our belief is that interest rates will continue to move higher to combat inflation, sacrificing employment along the way, leading to our neutral stance on equity and bonds.

Attractive opportunities within credit markets have led us to begin selectively adding to High Yield credit exposure within the Steadfast Fixed Income Pool. Yields to maturity are approaching 9%, significantly higher than the 2021 low, despite low default expectations and overall credit health remaining strong. We believe these yields are attractive compensation for the potentially higher risk the asset class poses.

Disrupted supply chains have been a significant contributor to inflation during the global economic recovery, although there are some signs that transport and manufacturing bottlenecks are easing. Pandemic restrictions like lockdowns and social distancing have mostly been lifted resulting in an improvement in labour shortages, air freight capacity has been increasing with the resurgence in passenger flights, and ocean/air freight rates continue to fall from their 2021 highs. Manufacturing efficiency has also been improving as semiconductor inventories are slowly rebuilding, although the risk of future disruptions has led some supply chain analysts to shift towards a new ‘Just‐In‐Case’ model for inventories.

Within our North American equity model, we’ve exited our position in Target Co (TGT) and reinvested proceeds into Whirlpool Co (WHR), the international home appliance company. Consumer demand for household appliances has been and is expected to remain resilient to economic pressures. Whirlpool recently revised their 2022 outlook downward given higher input costs, but guidance was still better than expected. The company is making significant investments into future growth, and we believe management has the expertise to grow margins across their portfolio businesses and expand their Europe, Middle East, and Africa (EMEA) segments.

Portfolio Contributors

- Nucor Co shares surged 30% after earnings beat both EPS and Revenue estimates. Management’s guidance for H2 2022 remains strong.

- iShares Global Clean Energy ETF gained 17% as valuations recovered on growth‐oriented stocks.

Portfolio Detractors

- Shares of Verizon Communications fell 8% after weaker than expected earnings. The telecom failed to meet new subscription targets.

- Procter & Gamble finished 3% lower after reporting earnings, although this was expected. Investors had been flooding into Consumer Staple stocks, pushing valuations beyond reasonable levels for their expected growth.

All returns are for the reported month and in local‐currency.

All data sourced from SIACharts and FACTSET.